What Is a Trial Balance? Everything You Need to Know 2023

In double-entry accounting, a credit to any account must be offset by a debit to another account. If your general ledger is accurate, the debit balance will equal the credit balance. Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.You can have access to Deskera’s ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant.

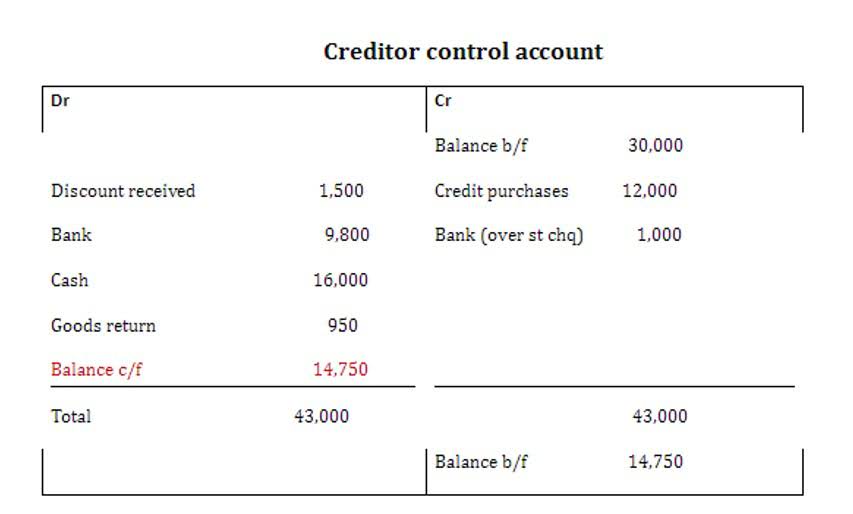

A discrepancy between balances means that there is an error somewhere in the accounting system. A trial balance is a list of credit entries and debit entries that businesses use to internally audit their double-entry accounting systems. The goal is to confirm that the sum of all debits equals the sum of all credits and identify whether any entries have been recorded in the wrong account. A debit could have been entered in the wrong account, which means that the debit total is correct, though one underlying account balance is too low and another balance is too high. For example, an accounts payable clerk records a $100 supplier invoice with a debit to supplies expense and a $100 credit to the accounts payable liability account. The debit should have been to the utilities expense account, but the trial balance will still show that the total amount of debits equals the total number of credits.

Or that an incorrect debit entry was accompanied with an incorrect credit entry as well. Once all balances are transferred to the unadjusted trial balance, we will sum each of the debit and credit columns. The debit and credit columns both total $34,000, which means they are equal and in balance. However, just because the column totals are equal and in balance, we are still not guaranteed that a mistake is not present.

Ready to Get Started with OHIO Online™?

Your trial balance should have your debits and credits equal at the bottom. First, the detection of errors using a trial balance relies on any arising discrepancies in the totals of the credit and debit columns. However, there can be instances where these totals are equal despite the presence of errors. It may have occurred that certain transactions were not recorded at all, and hence both the credit and debit sides were not affected.

The trial balance is strictly for use within the accounting department. It is not distributed elsewhere within an organization, and it is not read by outside parties, other than the auditors. Trial balance can be used to check arithmetical accuracy of ledgers. Take full advantage of accounting provisions available to business owners.

What is Trial balance Error-Are There Any Limitations of a Trial Balance?

For example, banks and lending agencies may use it to understand the borrowing capacity of a company and also its credibility. It is an essential procedure for the closure of books of accounts, but it is not error free. To make your accounting seamless, accurate and error free it is a good idea to move to a good accounting system like Deskera which is especially suitable for small businesses. This additional level of detail reveals the activity in an account during an accounting period, which makes it easier to conduct research and spot possible errors.

- The debits would still equal the credits, but the individual accounts are incorrect.

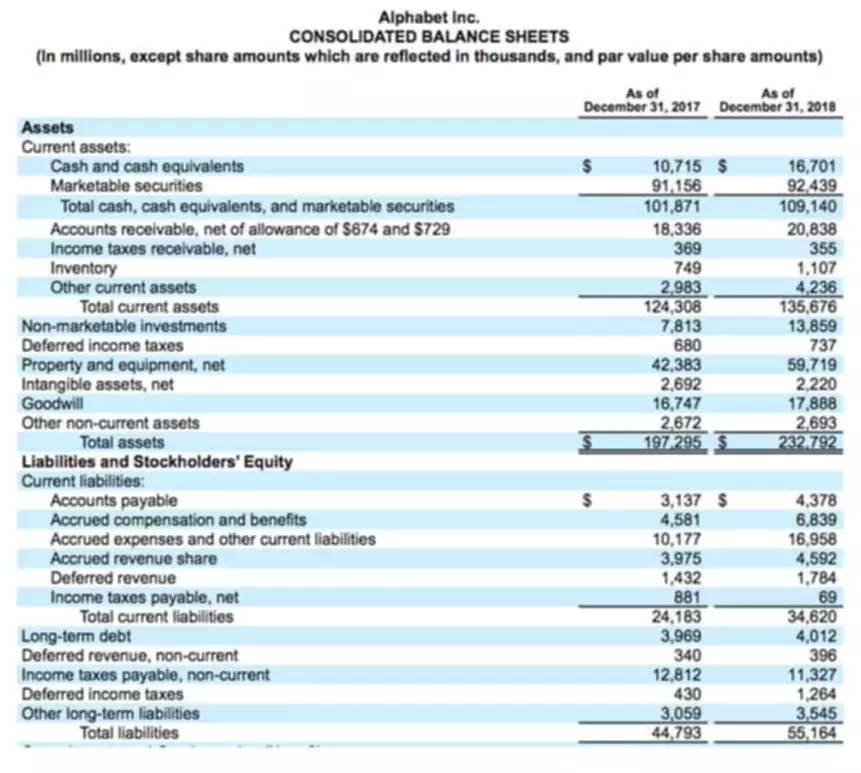

- The key difference between a trial balance and a balance sheet is one of scope.

- Trial balance is the records of the entity’s closing ledgers for a specific period of time.

- However, you can scan through the entire TB to ensure that the numbers of items are the same as your understanding.

- The unadjusted trial balance in this section includes accounts before they have been adjusted.

Once you complete closing all General Ledger, all you need to do is transfer the carrying forward balance to trial balance. If the closing balance per general ledger is at debit, then post in a credit of TB. Even Trail Balance is great for general ledger arithmetical checks and produces financial statements, yet TB is still limited for certain areas.

Types of Trial balance

It is a statement of debit and credit balances that are extracted on a specific date. All three of these types have exactly the same format but slightly different uses. The unadjusted trial balance is prepared on the fly, before adjusting journal entries are completed. It is a record of day-to-day transactions and can be used to balance a ledger by adjusting entries. By now, we are clear that trial balance’s primary objective is to ascertain the accuracy and detecting of errors.

Your Super’s Moon Balance Superfood Blend Reduced Period Symptoms in 86% of Clinical Trial Participants – Yahoo Finance

Your Super’s Moon Balance Superfood Blend Reduced Period Symptoms in 86% of Clinical Trial Participants.

Posted: Thu, 27 Jul 2023 12:00:00 GMT [source]

Not all accounts in the chart of accounts are included on the TB, however. Usually only active accounts with year-end balance are included in the TB because accounts with zero balances don’t make it on the financial statements. For example, if a company had a vehicle at the beginning of the year and sold it before year-end, the vehicle account would not show up on the year-end report because it’s not an active account.

When should a business use a trial balance?

Since it’s a common function of modern accounting software to create, update and report a trial balance automatically, it’s important to understand how the trial balance functions. As you can see, the report has a heading that identifies the company, report name, and date that it was created. The accounts are listed on the left with the balances under the debit and credit columns. The errors have been identified and corrected, but the closing entries still need to be made before this TB can used to create the financial statements. After the closing entries have been made to close the temporary accounts, the report is called the post-closing trial balance.

It is important to note that the unadjusted and adjusted trial balance is not the financial statements. It is the records used to prepare the drafting financial statements and double-checks the mathematical accuracy of ledgers. Adjusted trial balances are a type of trial balance issued after the initial trial balance is prepared. The adjusted trial balance accounts for information that is missing or misrepresented in the general ledger and can correct for errors identified in the initial report. The main user of the trial balance is the general ledger accountant (or the bookkeeper in a smaller business). This person uses it as part of the month-end and year-end closing process, to ensure that the debit and credit totals match.

Bookkeepers typically scan the year-end the definition, explanation and examples of tax free for posting errors to ensure that the proper accounts were debited and credited while posting journal entries. Internal accountants, on the other hand, tend to look at global trends of each account. For instance, they might notice that accounts receivable increased drastically over the year and look into the details to see why.

- Again, the entry would still balance, and so would not be spotted by reviewing the trial balance.

- After these errors are corrected, the TB is considered an adjusted trial balance.

- Furthermore, some accounts may have been used to record multiple business transactions.

- This lets you use your trial balance statement to track changes in specific accounts.

- In this method, the total value at the end of the debit and credit columns of a company’s ledger is recorded in the trial balance sheet.

On a trial balance worksheet, all of the debit balances form the left column, and all of the credit balances form the right column, with the account titles placed to the far left of the two columns. Preparing a trial balance for a company serves to detect any mathematical errors that have occurred in the double entry accounting system. If the total debits equal the total credits, the trial balance is considered to be balanced, and there should be no mathematical errors in the ledgers. However, this does not mean that there are no errors in a company’s accounting system. For example, transactions classified improperly or those simply missing from the system still could be material accounting errors that would not be detected by the trial balance procedure.

What is a trial balance used for?

In general, the ledgers listed down in the trial balance range from balance sheet items to income statement items. For the balance sheet items, assets items are range first and followed by liabilities and equities items. For the income statement items, revenues items are ranging above the expenses items. You can double-check this if you extract the TB from the accounting system. In this example, the total credit balance equals the total debit balance. While this alone cannot confirm that all entries have been entered correctly, it’s a good sign that your accounts are accurate.

The trial balance is strictly a report that is compiled from the accounting records. It is made as an attempt to prove that the total of ledger accounts with a debit balance is equal to the total of ledger accounts with a credit balance. As the name suggests, it is an actual “trial” of the debit and credit balances, they should be equal. For instance, in our vehicle sale example the bookkeeper could have accidentally debited accounts receivable instead of cash when the vehicle was sold. The debits would still equal the credits, but the individual accounts are incorrect. This type of error can only be found by going through the trial balance sheet account by account.