Is land a current asset?

Companies that report on an annual basis will often use December 31st as their reporting date, though they can choose any date. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

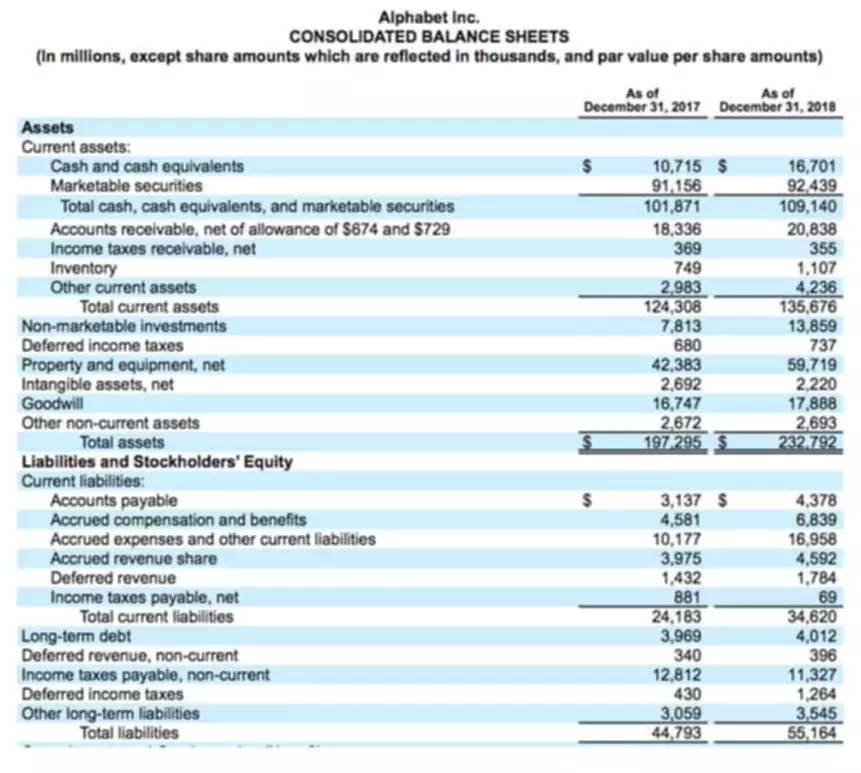

To do this, you’ll need to add liabilities and shareholders’ equity together. Depicting your total assets, liabilities, and net worth, this document offers a quick look into your financial health and can help inform lenders, investors, or stakeholders about your business. Based on its results, it can also provide you key insights to make important financial decisions.

An asset’s cost minus its accumulated depreciation is known as the asset’s book value or carrying value. Land built or designated for business uses, such as office buildings, retail establishments, and industrial facilities, is commercial real estate. This may refer to payroll expenses, rent and utility payments, debt payments, money owed to suppliers, taxes, or bonds payable. After enrolling in a program, you may request a withdrawal with refund (minus a $100 nonrefundable enrollment fee) up until 24 hours after the start of your program. Please review the Program Policies page for more details on refunds and deferrals. Updates to your application and enrollment status will be shown on your Dashboard.

Examples of Land as an Asset

As with assets, these should be both subtotaled and then totaled together. An asset is anything a company owns which holds some amount of quantifiable value, meaning that it could be liquidated and turned to cash. No, all of our programs are 100 percent online, and available to participants regardless of their location. There are no live interactions during the course that requires the learner to speak English.

Since the machinery and equipment will not last forever, their cost is depreciated on the financial statements over their useful lives. A balance sheet offers internal and external analysts a snapshot of how a company is performing in the current period, how it performed during the previous period, and how it expects to perform in the immediate https://www.kelleysbookkeeping.com/the-sunk-cost-fallacy/ future. For most companies, land is a strategic asset because it doesn’t go through the wear-and-tear other fixed assets experience. If an organization evolves in a sector where land ownership — and real estate holdings, in general — are key, the business must find ways to secure good deals on strategically situated parcels.

Why does our company’s balance sheet report its land at cost when it is so much more valuable?

The line buildings and improvements reports the cost of the buildings and improvements but not the cost of the land on which they were constructed. For financial statement purposes, the cost of buildings and improvements will be depreciated over their useful lives. The balance sheet’s liabilities section includes current and long-term liabilities, such as accounts payable, loans, and mortgages and equity section.

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

- Therefore, the recorded amount of goodwill is not amortized to expense.

- A balance sheet must always balance; therefore, this equation should always be true.

- Shareholders’ equity refers generally to the net worth of a company, and reflects the amount of money that would be left over if all assets were sold and liabilities paid.

- Whether you’re looking to understand your company’s balance sheet or create one yourself, the information you’ll glean from doing so can help you make better business decisions in the long run.

A company’s balance sheet is one of the most important financial statements it produces—typically on a quarterly or even monthly basis (depending on the frequency of reporting). Understanding and analyzing key financial statements like the balance sheet, income statement, and cash flow statement is critical to painting a clear picture of a business’s past, present, and 9 tips for small business taxes future performance. Knowing what goes into preparing these documents can also be insightful. Want to learn more about what’s behind the numbers on financial statements? Explore our eight-week online course Financial Accounting—one of our online finance and accounting courses—to learn the key financial concepts you need to understand business performance and potential.

Ask a Financial Professional Any Question

The $1 million difference is recorded as the intangible asset goodwill. Land refers to the land used in the business, such as the land on which the production facilities, warehouses, and office buildings were (or will be) constructed. The cost of the land is recorded and reported separately from the cost of buildings since the cost of the land is not depreciated. While long-term investments in marketable securities are initially recorded at their cost, the amount of these investments will be adjusted (increased or decreased) to report their market value as of the date of the balance sheet.

Is Land a Current Asset? FAQs

For example, a fast-food chain may establish a “land scouting” group to survey vast geographical expanses and pinpoint the best locations for new stores. Failure to do so could invite investor anger, and the company might experience a market share reduction down the road. Besides, external financiers may lend a plaintive tone to an already difficult situation by bidding the company’s shares down.

This financial statement is used both internally and externally to determine the so-called “book value” of the company, or its overall worth. A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. The ability to read and understand a balance sheet is a crucial skill for anyone involved in business, but it’s one that many people lack. The amount of a long-term asset’s cost that has been allocated to Depreciation Expense since the time that the asset was acquired. Accumulated Depreciation is a long-term contra asset account (an asset account with a credit balance) that is reported on the balance sheet under the heading Property, Plant, and Equipment.

Land is real estate that is exclusive of any buildings or other assets situated on the property. Depending on the terms of a land ownership agreement, the owner may be awarded the right to use all natural resources on and under the land, which may include water rights, fishing rights, mining rights, and so forth. The land is generally not disposed of or converted to cash within an accounting year; therefore, land cannot be classified as a current asset and thus is a long-term asset. Further support for the cost principle is the accountants’ going concern assumption. A company is assumed to be continuing in business and will not be liquidating. If your company bought the land for possible expansion, its cost is more relevant than the amount the company could get if it were liquidating.