Warning: Trying to access array offset on value of type bool in /var/www/wp-content/themes/enfold/framework/php/function-set-avia-frontend.php on line 536

Best Prime Brokers For Hedge Funds: Hedge Fund Accounts

But for the average person looking for high returns, investing in index funds that track main indices just like the S&P 500 is likely a greater option. Does that imply in the debate between hedge funds vs. mutual funds or ETFs that hedge funds at all times prime brokerage for intermediaries lose? The aim of hedge funds isn’t to necessarily outperform the indices; instead, they’re designed to provide development despite market circumstances. Minimum initial funding quantities for hedge funds range from $100,000 to upwards of $2 million.

How Many Prime Brokers Ought To A Hedge Fund Have?

Alfred Winslow Jones is often cited because the pioneer of the long-short fund strategy in the mid-1940s. Investment choices are grounded in detailed evaluation, analysis, and forecast fashions, which all contribute to formulating a extra logical judgment on whether to buy, promote, or maintain an asset. Run and customize activity statements to view detailed details about your account exercise, together with positions, cash balances, transactions, and more. Buy or promote any eligible US or European stocks/ETFs utilizing fractional shares, that are stock models that amount to lower than one full share, or by putting an order for a specific purchase worth quite than amount of shares. IBKR combines deep inventory availability, clear stock loan rates, global reach, devoted support and automated instruments to simplify the financing course of and permit you to give consideration to executing your strategies. This could influence which merchandise we evaluation and write about (and the place these products appear on the site), but it by no means affects our recommendations or advice, which are grounded in thousands of hours of research.

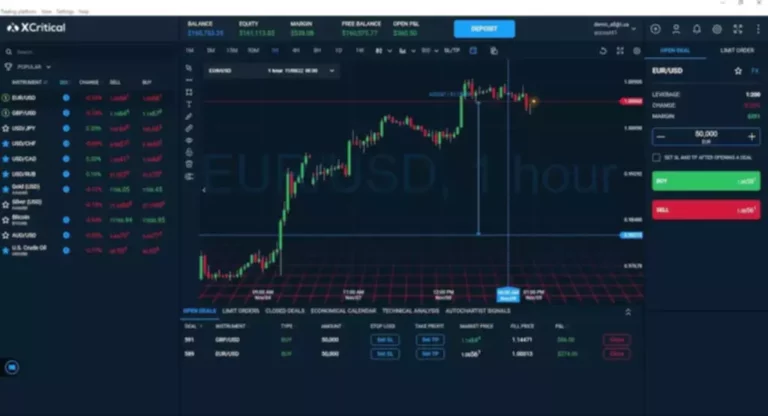

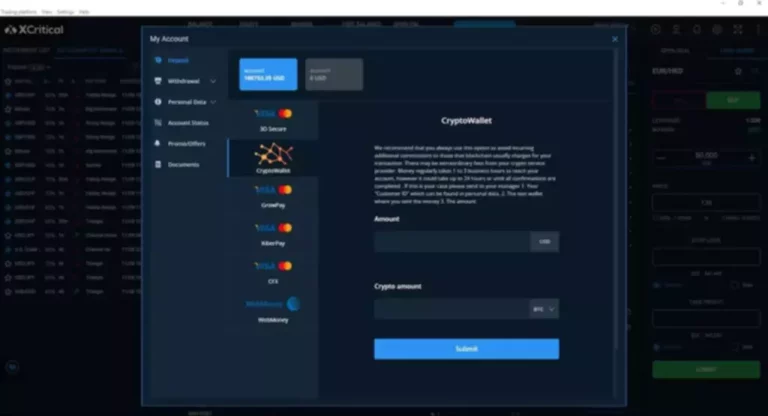

The Wharton Online & Wall Avenue Prep Buy-side Investing Certificate Program

Many hedge funds make use of several hundred individuals to help in managing money for shoppers. Marquee is Goldman Sachs’ digital market for institutional traders, providing a variety of cross-asset tools and providers to assist hedge funds handle their portfolios more successfully. It provides unparalleled access to world markets, enabling hedge fund managers to execute a variety of funding methods with larger velocity, effectivity, and transparency. With Marquee, hedge funds can entry the instruments and insights they need to make informed funding choices, monitor their portfolios in real-time, and preserve liquidity whereas building their companies. Finally, Saxo’s know-how helps hedge funds access and execute across world capital markets by way of its multi-asset prime brokerage and execution providers, proprietary platforms, and connectivity and APIs.

How Are Hedge Funds Totally Different From Mutual Funds?

If one funding does nicely, then the other loses money — theoretically reducing the overall danger to traders. This is actually the place the term “hedge” comes from, since utilizing varied market strategies might help offset risk, or “hedge” the fund in opposition to massive market downturns. For instance, hedge funds can use credit default swaps as threat safety in opposition to a adverse credit score event, so that even when the issuers misses a debt cost, the holders will receive a payout. Hedge fund managers have latitude to use extra aggressive trading methods than their mutual fund counterparts. They can make extremely concentrated bets by investing the fund’s capital in just some property, and they often use leverage, which involves borrowing money to make trades.

How Are Hedge Funds Categorised?

The investment technique utilized by multi-strategy funds is at their discretion, as such firms tend to prioritize capital preservation with a lower urge for food for risk. Historically, the usual payment structure within the hedge fund industry was the basic “2 and 20” association. The objective of the hedge fund business model remains the technology of long-term positive returns pushed by alpha, quite than market beta. Hedge funds are investment vehicles designed to generate stable, non-volatile returns, impartial of prevailing market conditions. The danger of loss in online trading of shares, choices, futures, currencies, overseas equities, and glued income can be substantial.

The majority of hedge funds have crushed their benchmark indexes since inception; not at all times, however typically enough to make them enticing autos for an investor to add risk-adjusted worth to his or her portfolio. In discretionary buying and selling, the fund manager selects investments primarily based on analysis, whereas within the systemic method, they use laptop fashions and programs. They might purchase securities on margin, or acquire loans and credit score traces to fund much more purchases. The quick model of the story goes that if the funding can generate a large enough return to cowl curiosity costs and commissions (on borrowed funds), this type of buying and selling could be a highly efficient technique. Hedge funds may look for and attempt to seize upon mispricings throughout the market.

Hedge Fund Industry At A Glance

Often, an funding in distressed securities can turn out to be a complex, long-winded process, since most corporate bankruptcies are in-court restructuring, rather than out-of-court. The technique of those funds shifts constantly and is contingent on latest developments in financial insurance policies, international occasions, regulatory policies, and overseas policies, i.e. “directional analysis”. The expected portfolio return of a market-neutral fund is the sum of the risk-free rate and the alpha generated by the fund’s portfolio. That stated, the returns on a market-neutral fund are structured to be impartial of actions of the broader market, with less volatility danger. Put together, the paired long and brief positions balance the portfolio’s long positions with their short positions, with the core objective of attaining a web portfolio publicity of zero, i.e. a portfolio beta of zero.

- For years, hedge funds have retained a sure level of mystery about them and the finest way they operate; and for years, public corporations and retail traders have tried to determine the methods behind their (sometimes) obvious madness.

- These funds can be categorised by the complicated strategies their fund managers undertake to take care of their funds.

- Hedge funds took off within the Nineteen Nineties when a quantity of high-profile cash managers abandoned the mutual fund business for fame and fortune as hedge fund managers.

- Our article has provided an outline of the top prime brokers for hedge funds.

- UBS provides a comprehensive suite of prime brokerage services to hedge funds tailor-made to their financial objectives.

In India, the Securities and Exchange Board of India (SEBI) launched hedge funds as a part of the SEBI (Alternative Investment Funds) Regulations in 2012. Hedge funds are categorized as class III different investment funds in India. However, they’re still in their nascent stage and require further regulation. Hedge funds must adhere to restrictions and rules together with recordkeeping and trade reporting necessities of publicly traded securities. Many of the hedge funds in the U.S. are regulated by the Commodity Futures Trading Commission (CFTC), Commodity Pool Operators (CPO), and Commodity Trading Advisors (CTA). But these funds still appeal to plenty of attention for his or her spectacular track records and skill to seemingly defy gravity.

They are additionally a extremely risky investment vehicle, and the tax on such funds is also high. The majority of hedge fund buyers are accredited, meaning they earn very high incomes and have existing web worths in excess of $1 million. For this cause, hedge funds have earned the doubtful reputation of being a speculative luxury for the rich. Hedge funds are risky compared with most mutual funds or exchange-traded funds. They are also unconstrained in their investment picks, with the freedom to take big positions in different investments. If you qualify as an accredited investor and are keen to invest tons of of hundreds of dollars—or even millions—at once, investing in hedge funds may be a smart way to diversify your profile and hedge in opposition to market volatility.

When it goes well, hedge funds will pay out huge returns to investors, but when it goes poorly, hedge funds also can lose cash for investors rapidly. An overabundance of capital influx into hedge funds has increased competition for investments in these relatively illiquid property. This leads to funds looking for opportunities in much less liquid property such as rising markets, distressed securities, convertible bonds, personal equities and actual property. Hedge funds are categorised primarily based on the strategies utilized by the fund supervisor. There may also be multiple strategies at play for a fund depending on the danger management, diversification, or flexibility to fulfill the risk and returns profile of the fund.

Hedge Funds pool cash from bigger buyers like excessive networth people (HNI), endowments, banks, pension funds and business companies. This pooled money is used to put cash into such securities in nationwide and worldwide markets. A hedge fund is a pooled investment that’s pulled by a partnership of institutional or accredited investors. Global macro hedge funds spend money on shares, bonds, and currencies in an try and revenue from the impact of political or economic occasions on a selected market.

Fundamentals have more and more driven stock costs in 2024 with micro-level drivers accounting for the majority of value adjustments, as opposed to the more macro-driven surroundings that continued throughout 2022 and much of 2023. We see further proof of the fundamentally driven environment within the efficiency of the quick interest factor, which has declined considerably year thus far, as elementary performance has driven declines in closely shorted stocks. In credit score markets, important progress has been made towards lowering a looming maturity wall.

They collect cash from a pool of traders and use that cash to spend money on different belongings and there could be a fund manager who manages the fund as well. However, there are specific factors of distinction between hedge fund vs mutual fund. Investors are charged a 2% administration charge, whatever the efficiency of the hedge fund.

The traders are often high-net-worth people, family endowments, pensions, insurance coverage companies, and banks who pool their cash to create a fund managed by a fund manager. Alfred Winslow Jones is extensively credited with creating the primary hedge fund strategy in 1949. These hedge funds would buy inventory in corporations where worth was anticipated to increase, and borrow and sell stocks where worth was anticipated to lower. The goal, Katz says, “was to attempt to make its traders earnings in both ‘bull’ (up) and ‘bear’ (down) markets.” To shield in opposition to market uncertainty, the fund might make two investments that respond in opposite methods.

Chanos was one of many earlier skeptics of Enron and publicly questioned the opaque financial statements of Enron. Despite the unfavorable connotation attributed to brief sellers, Enron’s downfall is a historic precedent, reflecting the need for research-based short-selling and skeptics in the market. For that reason, short specialists are inclined to make fewer investments and are willing to hold onto capital for longer intervals to capitalize on alternatives similar to fraudulent habits related to accounting fraud, malfeasance, and extra.

Read more about https://www.xcritical.in/ here.